Jakarta – Foreign domination of strategic economic sectors is spreading and deepening. It has been suggested that the government reorganised strategic economic development so the benefits are more evenly felt by the ordinary people and greater competitiveness in the face of global competition.

Foreign domination has become progressively stronger in strategic sectors such as energy and mineral resources, telecommunication and the plantation sector. With this kind of foreign domination, the economy often appears to have been hijacked by their interests.

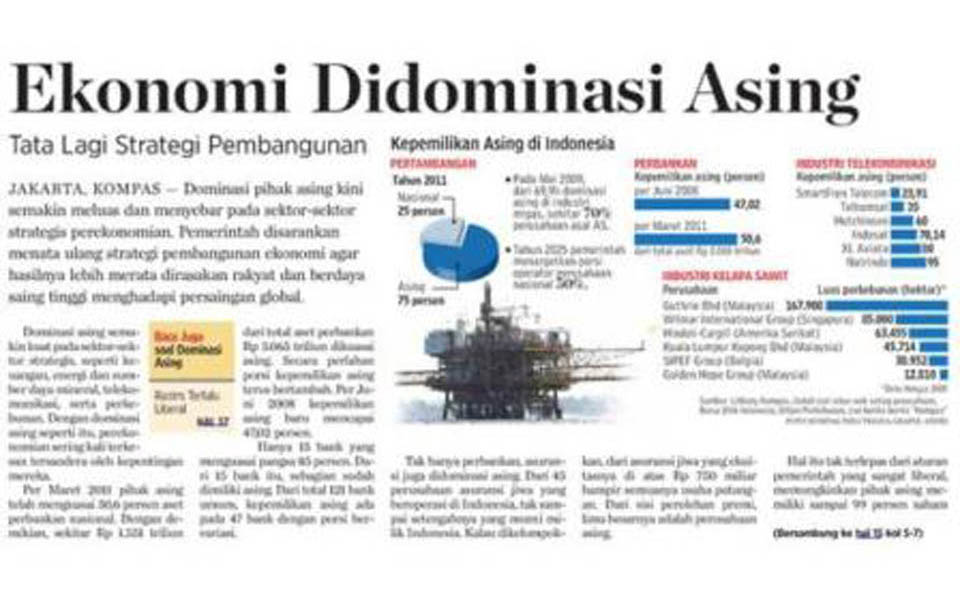

As of March 2011, foreign interests controlled 50.6 percent of national banking assets. Accordingly, around 1,551 trillion rupiah of the country’s total banking assets of 3,065 trillion rupiah are controlled by foreigners. Foreign ownership continues to grow slowing but surely. As of June 2008, foreign ownership was only 47.02 percent.

Only 15 banks control an 85 percent share of the market. Foreign interests already own some of these 15 banks. Out of a total of 121 commercial banks, 47 are owned by foreigners in varied portions.

And it is not just the banking. Insurance is also dominated by foreigners. Out of the 45 life insurance companies operating in Indonesia, less than half are fully owned by Indonesia. If grouped, of the life insurance companies with equities above 750 billion rupiah, all are joint venture businesses. In terms of premium earnings, the five largest are foreign companies.

This also needs to be understood in terms of government regulations that are extremely liberal, allowing foreign interests to own up to 99 percent of shares in the banking sector and 80 of shares in insurance companies.

The capital market is similar. Total foreign investor ownership is 60-70 percent and all of the company shares recorded and traded on the stock market.

This is also the case for former state-owned enterprises (SOE). Out of all the SOEs that have been privatised, foreign ownership has already reached 60 percent.

The oil and gas sector is even more tragic again. The proportion of national oil and gas operators is only around 25 percent while the remaining 75 percent is controlled by foreign interests. The government, through the Department of Energy and Mineral Resources is aiming for a 50 percent proportion to be operated by national companies by 2025.

Economic strategy

Reflecting on this situation, it is time that Indonesian’s economic revival driven by its own national strengths be rethought. Strategic economic development must be reorganised so that it is more orientated toward resource empowerment and above all allocated towards the national interest.

Indonesia does not need to apply anti-foreign strategic economic development but rather the presence of foreigners being a compliment to efforts to empower and revive the national economy.

This kind of thinking was raised by a number of groups when asked for their views about the current situation and efforts to revive the Indonesian economy and in relation to the commemoration of National Awakening Day on May 20 last week. Those who were asked for their views were former Vice President Jusuf Kalla, economist Didik J. Rachbini, House of Representatives member Arif Budimanta and people from business circles.

The current economic situation in Indonesia can also be seen from the poverty rate that has tended to flatten out without any significant decline, the still high level of unemployment and the gross domestic product that is only enjoyed by and contributed to by a handful of people. The character of the Indonesian economy has also not changed greatly when compared with the Dutch colonial period. Exports are still dominated by primary commodities while the manufacturing sector is showing signs of deindustrialisation (See Deindustrialisation, Phase 2).

Reevaluation

Indonesia’s strategic economic development polices do not have to be anti-foreign as is the case in Latin America. Although foreign participation to stimulate the economy is still needed, it should not dominate the economy.

Arif Budimanta believes that the government must have the courage to reevaluate economic policies as a consequence of the signing of the agreement with the International Monetary Fund (IMF) in 1997. The banking sector must be organised more exclusively, tariffs and import duties on strategic commodities need to be revised and natural resource management work contracts renegotiated (energy and mining).

Jusuf Kalla said that said that Indonesian’s economy does indeed need more clarity and direction in order for it to benefit domestic interests. This will require increasing national economic competitiveness, prioritising natural resources, particularly energy, for the national interests. Only the surplus should be exported.

He added the main steps must be begun systematically and consistently. He gave the example of rice self-sufficiency in 2008, but the following year the country was importing rice again. Likewise with military equipment, such as armoured vehicles, than can be produced domestically.

“This is because we have been inconsistent in pursuing successful policies. So, don’t forget our strengths, you want the easy way, better to import rice that work hard”, said Kalla.

Source: Ekonomi Didominasi Asing – Komaps. Senin, 23 Mei 2011

[Abridged translated by James Balowski.]